when are property taxes due in lake county illinois

Return to County Assessor - click here. Property owners may pay their property taxes under the following schedule without penalty.

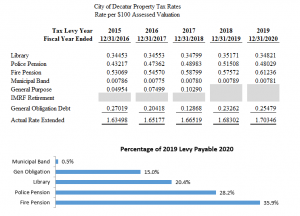

Property Tax City Of Decatur Il

Find Lake County Property Tax Info From 2021.

. By proceeding to use this website each visitor agrees to waive release and indemnify Lake County its agents consultants contractors and employees from any and all claims actions or causes of action for damages or injury to persons or property arising from the use or inability to use Lake County. LAKE FOREST IL 60045-2451. The first installment of property tax bills is due on June 8.

Lake County property owners will receive their property tax bills as scheduled and be expected to pay them by June 8. Return to County Treasurers Office - click here. The Lake County Treasurers office will be accepting prepayments for tax year 2021 due in calendar year 2022 from December 15th through December 29th.

Learn all about Lake County real estate tax. With an average tax rate of 216 Lake County Illinois collects an average of 6285 a year per resident in property taxes. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe.

45 penalty interest added per State Statute. Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of. Illinois property tax rebate proposal.

1st installment due date. Whether you are already a resident or just considering moving to Lake County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Lake County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes. The median property tax also known as real estate tax in Lake County is 628500 per year based on a median home value of 28730000 and a median effective property tax rate of 219 of property value. 2021 Taxes Payable in.

Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax. Under the new plan only half of the first payment will be due at the time.

Ill be making sure the office carries out its required duties and becomes a place where Lake County residents can get answers to their questions about how tax dollars are being spent. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. 50 of first installment normally due in full on June 8.

Discover Lake County Il Tax Bill for getting more useful information about real estate apartment mortgages near you. Payments should be made by check clearly identified as a property tax prepayment and include your PIN number. LAKE FOREST IL 60045.

See how your individual property taxes are distributed for any parcel and how to contact those taxing bodies on Lake Countys Tax Distribution website. The County Board decided against delaying the collection of taxes or waiving. CHICAGO WBBM NEWSRADIO -- Lake County Illinois property owners are getting more time to pay each installment of their property taxes due to impacts of COVID-19.

Lake County ranks 18th of the 3143 counties for property taxes as a percentage of median income making property taxes in this area notably higher than both the state and national averages. We perform a vital service for Lake Countys government and residents and Im honored to serve as your Treasurer. Current Real Estate Tax.

Review the policy for returned checks due to stop payments non-sufficient funds or other reasons. Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. 3 penalty interest added per State Statute.

50 remainder of first installment normally due on June 8. Return to County Clerk - click here. The other 50 percent is.

Lake County collects on average 219 of a propertys assessed fair market value as property tax. The exact property tax levied depends on the county in Illinois the property is located in. Lake County IL 18 N County Street Waukegan IL 60085 Phone.

Ad Search Lake County Records Online - Results In Minutes. Under the ordinance Lake County property owners must still pay the full amount of property taxes due. In most counties property taxes are paid in two installments usually June 1 and September 1.

847-377-2000 Contact Us Parking and Directions. Check out your options for paying your property tax bill. View maps of different taxing districts in Lake Countys Tax District Map Gallery.

Property tax bills mailed. Last day to submit changes for ACH withdrawals for the 1st installment. At its May 12 meeting the Lake County Board passed several measures in response to the COVID-19 pandemic including the property tax extension which allows taxpayers to spread their property.

15 penalty interest added per State Statute. Lake County IL Property Tax Information - Home Page. Lake County has one of the highest median property taxes in the United States and is ranked 15th of the 3143 counties in order of median property taxes.

Payments that are mailed must have a postmark of. The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300. Contact your county treasurer for payment due dates.

Lake County IL Property Tax Information. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022. The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021.

Prepayment amounts are limited to the tax amount due in 2020 as a maximum.

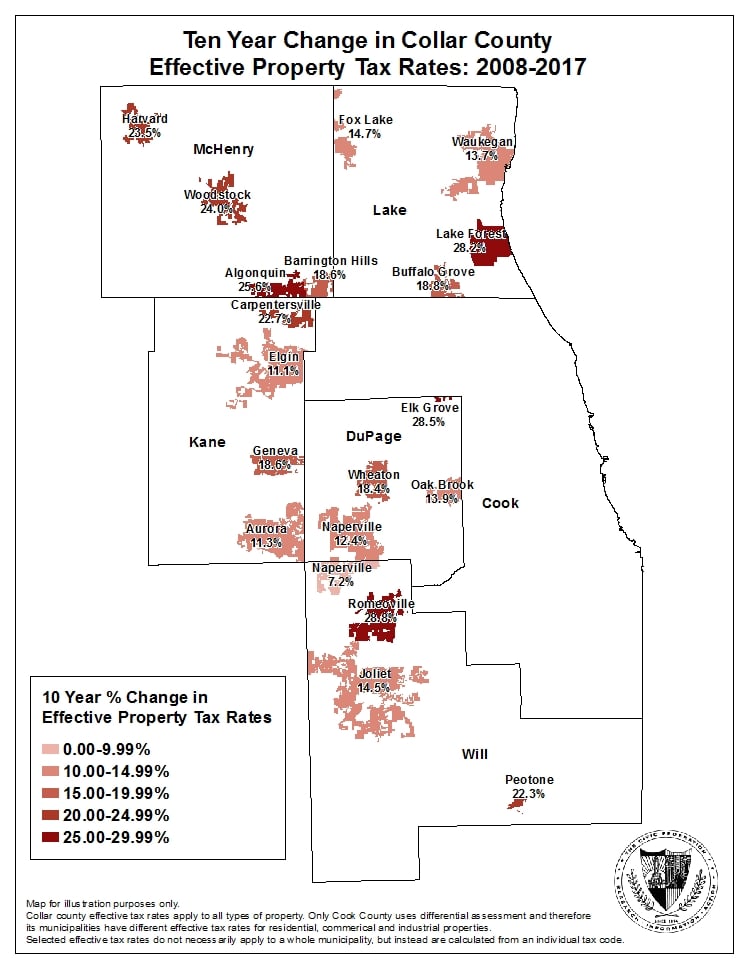

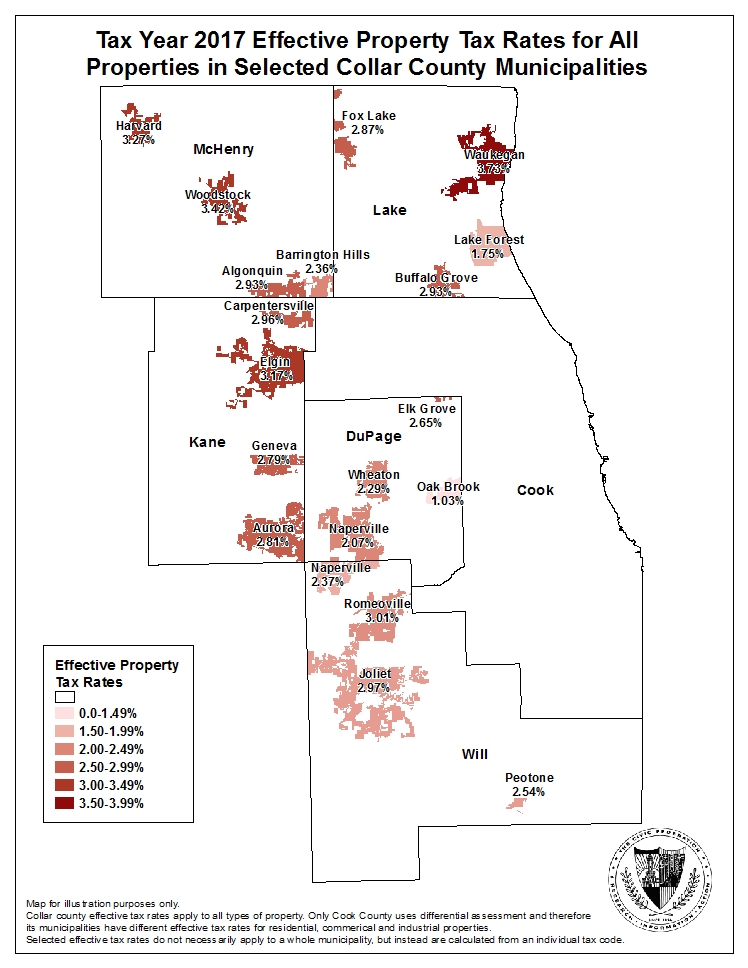

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Lake County Assessors Clash Over Property Value Hikes Lake County Property Values Lake

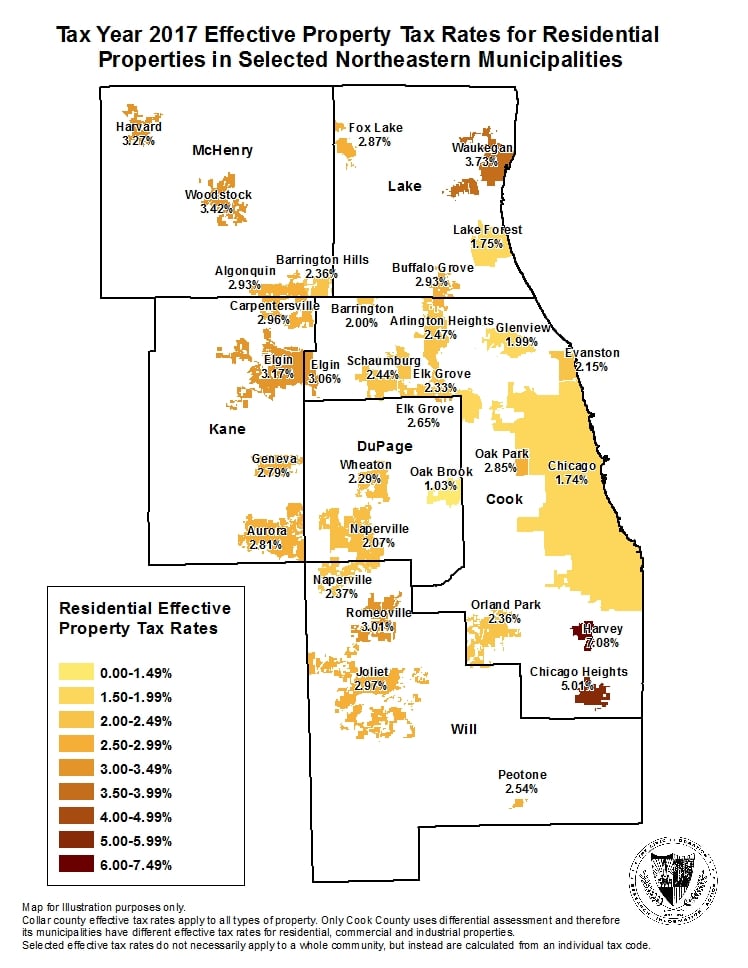

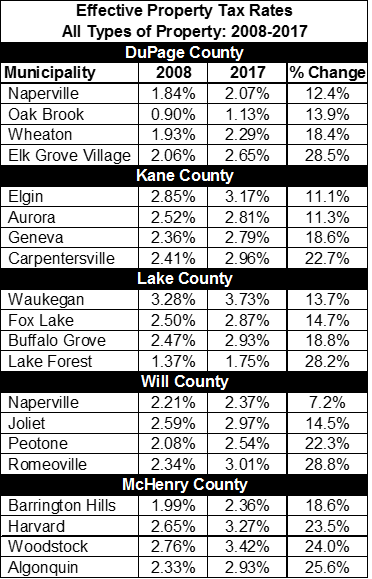

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

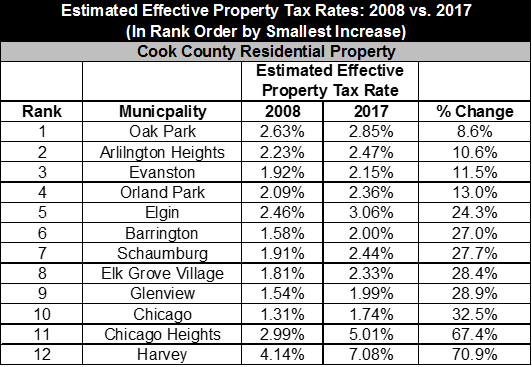

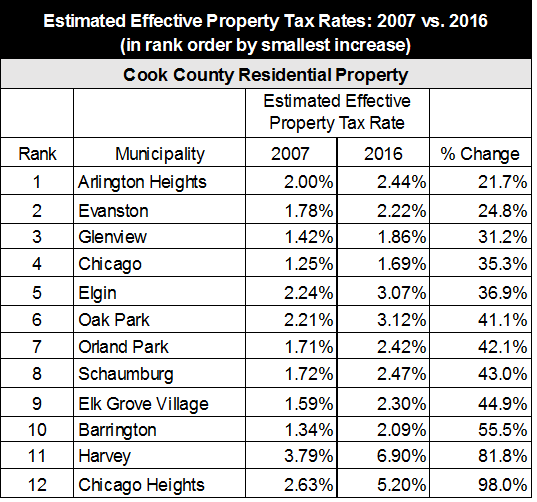

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Lake County Il Property Tax Information

Being Politic In Ellen Noise Noise Ellen Property Tax

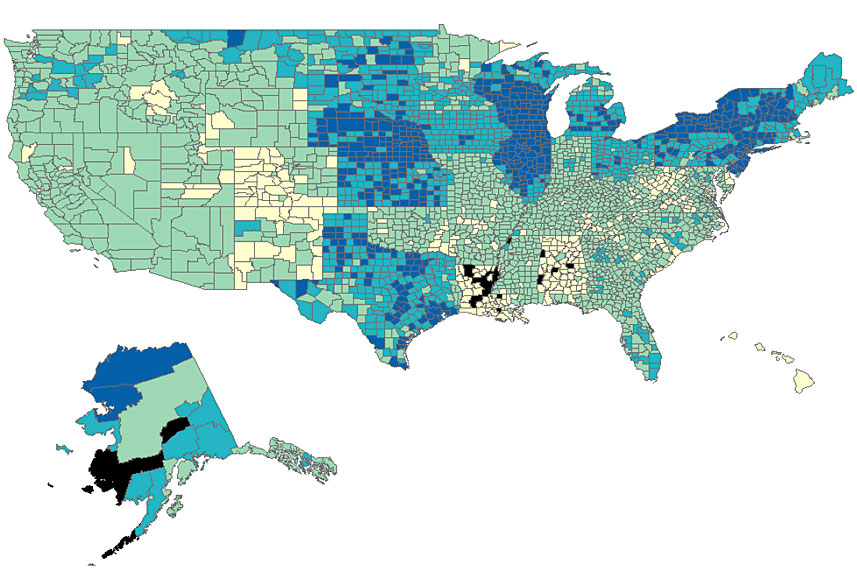

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Understanding The Tax Cycle Lake County Il

When Is The Cook County Property Tax Bubble Going To Burst Cook County Property Tax Law Blog

Township Assessors Get 3 000 Bonus For Doing Job Right Township Job Property Tax

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Lake County Il Property Tax Information

The Cook County Property Tax System Cook County Assessor S Office Property Tax County New Trier

The Cook County Property Tax System Cook County Assessor S Office